Tax Deductions

A deduction is an item that allows you to take a tax benefit up to the entire amount of the deduction. The good news is that this reduces your taxable income by the amount of the deduction, i.e., by using the deduction you end up paying a lesser amount in taxes. Just as an illustration, lets take the following simple mathematical example.

A deduction is an item that allows you to take a tax benefit up to the entire amount of the deduction. The good news is that this reduces your taxable income by the amount of the deduction, i.e., by using the deduction you end up paying a lesser amount in taxes. Just as an illustration, lets take the following simple mathematical example.

Amit’s income is Rs.100

Amit’s eligible deduction is Rs.20

Therefore, Amit’s taxable income is Rs.80

If Amit did not have a deduction, then his taxable income would have been Rs.100

By using the deduction Amit has saved taxes on up to Rs.20

What are the most commonly available deductions?

There are 4 most commonly used deductions that most people can avail of. These are popularly known by the section of the Income Tax Act under which they appear. Click on each of them to get more details.

80C deduction: Up to Rs.1 lakh, and used towards certain investments, payment of insurance premium, repayment of home loan principal amount, provident fund etc.

80D deduction: Up to Rs.15,000, and used towards annual medical expenses

80E deduction: Deduction of entire amount of interest paid on higher education loan for any family member

80G deduction: Deduction for contribution to charitable organization

In addition to these, there are numerous other deductions that are less common or that might not usually apply to you. Please check with your tax advisor if you might be eligible for any other deductions.

80C Deduction:Check out the eligible instruments

This allows a deduction for specific investment, contribution, deposits or payments made by the taxpayer during the tax year.

Who is it available to?

All individuals and HUF (Hindu Undivided Family).

What is the amount of the deduction?

A total of Rs.1 lakh in aggregate across all eligible 80C instruments.

What are the eligible instruments?

The most commonly used eligible instruments towards the 80C deductions are:

-

Life insurance premium, including premium for a unit-linked insurance plan (ULIP)

-

Contribution to Public Provident Fund or Provident Fund

-

Investment in pension plans

-

Investment in Equity Linked Savings Schemes (ELSS) of mutual funds

-

Home loan principal repayment

-

Investment in Infrastructure Bonds, National Savings Certificates

-

Payment of tuition fees to for full-time education of any 2 children of an individual

-

Fixed deposit with any scheduled bank or post office for 5 years

-

Senior citizens savings scheme

Please check with your tax advisor in case from time to time there are other instruments that become eligible under 80C.

80E Deduction:Check out the eligible instruments

This allows a deduction for payment of interest of loan taken towards higher education.

Who is it available to?

The deduction can be taken by the taxpayer for his/her higher education loan or for any member of the taxpayer’s family. The amount must have been paid using the taxpayer’s income chargeable to tax.

What is the amount of the deduction?

The entire payment of interest is deductible. The deduction is available for a maximum period of 8 years or till the principal and interest amount have been repaid, whichever comes earlier.

What are the eligible instruments?

The 80E deduction is usable only in the case of loan taken for higher education from a financial institution or recognized charitable institution. In this context, higher education means full-time studies for any graduate or post-graduate course specifically in engineering, medicine, management, applied sciences, mathematics or statistics. Please make yourself familiar with whether your course and subject of study are eligible for this deduction.

Please check with your tax advisor in case from time to time there are changes to the amount of deduction under 80E and the types of education loans permitted.

80G Deduction:Check out the eligible instruments

This allows a deduction for donations made to recognized charities and charitable institutions.

Who is it available to?

The deduction can be taken by any individual, HUF (Hindu Undivided Family), firm or company. Please note that donations made in kind are ineligible for the deduction.

What is the amount of the deduction?

The deduction available is 100% of the amount contributed to the charity, or in some cases 50% of the amount, which may further be with or without restriction. This calculation can get a little complicated, so its best if you ask your tax advisor on the total amount that you will be eligible for. Also, different charities get treated differently, so best to seek professional advice on this matter depending upon the charity of your choice.

What are the eligible charities and charitable institutions where my donations are eligible for the deduction?

Common charities that are eligible for this deduction are the Prime Minister’s National Relief Fund, Prime Minister’s Drought Relief Fund. Before making a donation, please check with the charity if it is recognized and has been registered with the appropriate authorities.

If you make a donation to a notified temple, mosque, gurudwara or church, it might also be eligible but please confirm that this place of worship has been registered with the authorities. As mentioned above, donations made in kind are ineligible for the deduction, so make sure that you pay by cheque or bank draft and keep record of the transaction.

Please check with your tax advisor in case from time to time there are newer charitable institutions that become available or there are changes to the amount of deduction under 80G.

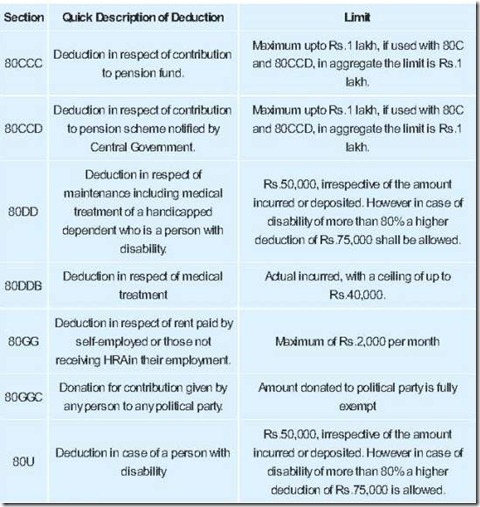

Less Commonly Used Tax Deductions

Under section 80 of the Income Tax Act, there are other less commonly used deductions. Please check with your tax advisor on how to use them, if you are eligible for these

Top Misconceptions about Taxes

Do I need to file my tax returns? How do I file them?

Misconception 1:

- My employer has deducted tax at source from my paycheck and thus I don’t have to worry about filing tax returns.

- Just because taxes have been paid on your behalf does not mean that filing a tax return is not required. If your combined annual income from all sources is above the amount that is exempt from income tax you are required to file your returns. Your employer gives to you a statement called Form 16 at the end of the financial year that shows the amount of tax that has been deducted at source. You will need to put the tax deduction amount shown on the Form 16 on your tax return form. Therefore, it is important to ensure that you obtain this statement from your employer on time.

Misconception 2:

- Filing tax returns is a complex and cumbersome process. I need a Chartered Accountant to help me file my tax returns.

- Contrary to popular belief preparing and filing a tax return is actually quite simple. In fact if you have a digital signature you can accomplish the entire process sitting at home on your computer thanks to the e-filing facility available on the tax department website (www.incometaxindiaefiling.gov.in). Alternatively, you can submit the returns online, print a one-page receipt, sign it and drop it off at the income tax office within fifteen days of submitting the returns. No documents are required to be submitted with the receipt. If you so desire, you can fill out the forms on your own. However, if you want professional help there are many third party service providers who offer tax preparation and filing services for as low as Rs.200.

Housing and tax

Misconception 3:

- he interest I pay on a home loan is deductible from my income from house property up to a maximum of Rs. 1,50,000 per year.

- This is true if you have taken a home loan for a single house and it is self-occupied. However, if you take a home loan on a second house, the entire interest paid on the loan can be claimed as a deduction from your income on house property. If you are planning to invest in real estate with the expectation that the property would appreciate in value over time, you could take advantage of the above rule. Thus a smart investment strategy would be to take a home loan on a second house, rent out the house and claim interest paid on the loan as a deduction from the rental income, thereby reducing your borrowing costs significantly.

Misconception 4:

- I receive tax exemption on the actual rent I pay for my rented home. This is not entirely accurate. Section 13 A of the Income Tax Act states that the maximum amount that is exempt from tax is the lower of the following amounts: (i) the House Rent Allowance given by the employer, (ii) 50% of your basic salary if you live in a metro, (iii) or, actual rent paid minus 10% of your basic salary. Thus if actual rent paid is lower than 10% of your basic salary you receive no exemption. The other key point is that you cannot claim any exemption under this section if you live in your own home or if you are not paying rent to anyone.

The magical 80’s

Misconception 5:

- Section 80C benefits are available only on making an investment or saving or paying a premium on insurance.

- You can claim a deduction for the school or university tuition fees you pay for your children (maximum of two) as long as they are enrolled in a full time program at any institute in India. In addition you can claim a deduction for the repayment of principal on any home loan that you may have taken. Both these deductions have to of course be within the overall annual Section 80C cap of Rs.1lakh.

Misconception 6:

- If I avail of tax free medical reimbursement from my employer up to Rs.15,000, I cannot claim deduction on health insurance premium paid.

- Tax free medical reimbursement by your employer up to an amount of Rs.15,000 per year for your family’s medical expenditure is separate from the Rs.15,000 deduction available under Section 80D for the premium you pay on buying health insurance. Both these exemptions are covered under different sections of the Income Tax Act and you can enjoy benefits from both. The former covers costs for your daily medical needs and outpatient treatment (OPD), while the latter protects you from expenditure for hospitalization.

Misconception 7:

- My friends tell me that the only interest payment I can claim an exemption for is the interest paid on home loans.

- There is a section of the Income Tax Act called 80E that permits deduction on interest paid on loans taken for higher education for self, spouse and children. There is no limit on the amount of deduction you can claim. The only thing to keep in mind is that the program for which the loan is taken should be a graduate or post-graduate program in engineering, medicine or management or a post-graduate course in the pure or applied sciences.

Interest income and others

Misconception 8:

- Interest I earn on my savings account balance is exempt from income tax.After the removal of Section 80L of the Income Tax Act, interest income from any source including savings account balance, is subject to income tax. What you may be referring to is the rule around tax deducted at source for the interest payments you receive on your savings account. As per existing rules, as long as the combined interest income that you earn, on any savings accounts or fixed deposits, at a single bank branch, is less than Rs.10,000 there will be no tax deducted at source. If you want to better manage your cash flow and do not want tax to be deducted at source you could consider spreading your deposits across multiple bank branches, even if they are of the same banking company.

Misconception 9:

- I have to pay taxes on interest received from my fixed deposits only on maturity.

- Your tax liability on interest income from your fixed deposit is calculated on an accrual basis. Let’s say that you have made a fixed deposit for three years and have elected not to receive any regular interest payouts and instead have decided to receive a lump sum payout on maturity after three years. That does not mean that you are not liable to pay income tax annually on the interest that is credited to your fixed deposit account every year, even though you do not have access to that interest income.

Misconception 10:

- I received cash as a gift from a close friend. I do not have to pay any tax.

- You are right as long as the amount was less than Rs.50,000 during the financial year. The applicable rules for gift tax state that any cash gifts, without any upper limit, received from specified relatives are exempt from income tax. However, if you receive a cash gift from a friend, which exceeds Rs.50,000 in one financial year, you are liable to pay income tax on the entire amount. However, the good news is that cash gifts received during your marriage, of any amount, and from anyone are totally free from income tax.

Regards,

Pinal Mehta

Human Resources