Tags: Boss, Employee, expectations, experience, funny, hilarious, humor, joke, Jokes, office

Archive | HR Articles RSS feed for this section

Tax Deductions FAQs

14 DecTax Deductions

A deduction is an item that allows you to take a tax benefit up to the entire amount of the deduction. The good news is that this reduces your taxable income by the amount of the deduction, i.e., by using the deduction you end up paying a lesser amount in taxes. Just as an illustration, lets take the following simple mathematical example.

A deduction is an item that allows you to take a tax benefit up to the entire amount of the deduction. The good news is that this reduces your taxable income by the amount of the deduction, i.e., by using the deduction you end up paying a lesser amount in taxes. Just as an illustration, lets take the following simple mathematical example.

Amit’s income is Rs.100

Amit’s eligible deduction is Rs.20

Therefore, Amit’s taxable income is Rs.80

If Amit did not have a deduction, then his taxable income would have been Rs.100

By using the deduction Amit has saved taxes on up to Rs.20

What are the most commonly available deductions?

There are 4 most commonly used deductions that most people can avail of. These are popularly known by the section of the Income Tax Act under which they appear. Click on each of them to get more details.

80C deduction: Up to Rs.1 lakh, and used towards certain investments, payment of insurance premium, repayment of home loan principal amount, provident fund etc.

80D deduction: Up to Rs.15,000, and used towards annual medical expenses

80E deduction: Deduction of entire amount of interest paid on higher education loan for any family member

80G deduction: Deduction for contribution to charitable organization

In addition to these, there are numerous other deductions that are less common or that might not usually apply to you. Please check with your tax advisor if you might be eligible for any other deductions.

80C Deduction:Check out the eligible instruments

This allows a deduction for specific investment, contribution, deposits or payments made by the taxpayer during the tax year.

Who is it available to?

All individuals and HUF (Hindu Undivided Family).

What is the amount of the deduction?

A total of Rs.1 lakh in aggregate across all eligible 80C instruments.

What are the eligible instruments?

The most commonly used eligible instruments towards the 80C deductions are:

-

Life insurance premium, including premium for a unit-linked insurance plan (ULIP)

-

Contribution to Public Provident Fund or Provident Fund

-

Investment in pension plans

-

Investment in Equity Linked Savings Schemes (ELSS) of mutual funds

-

Home loan principal repayment

-

Investment in Infrastructure Bonds, National Savings Certificates

-

Payment of tuition fees to for full-time education of any 2 children of an individual

-

Fixed deposit with any scheduled bank or post office for 5 years

-

Senior citizens savings scheme

Please check with your tax advisor in case from time to time there are other instruments that become eligible under 80C.

80E Deduction:Check out the eligible instruments

This allows a deduction for payment of interest of loan taken towards higher education.

Who is it available to?

The deduction can be taken by the taxpayer for his/her higher education loan or for any member of the taxpayer’s family. The amount must have been paid using the taxpayer’s income chargeable to tax.

What is the amount of the deduction?

The entire payment of interest is deductible. The deduction is available for a maximum period of 8 years or till the principal and interest amount have been repaid, whichever comes earlier.

What are the eligible instruments?

The 80E deduction is usable only in the case of loan taken for higher education from a financial institution or recognized charitable institution. In this context, higher education means full-time studies for any graduate or post-graduate course specifically in engineering, medicine, management, applied sciences, mathematics or statistics. Please make yourself familiar with whether your course and subject of study are eligible for this deduction.

Please check with your tax advisor in case from time to time there are changes to the amount of deduction under 80E and the types of education loans permitted.

80G Deduction:Check out the eligible instruments

This allows a deduction for donations made to recognized charities and charitable institutions.

Who is it available to?

The deduction can be taken by any individual, HUF (Hindu Undivided Family), firm or company. Please note that donations made in kind are ineligible for the deduction.

What is the amount of the deduction?

The deduction available is 100% of the amount contributed to the charity, or in some cases 50% of the amount, which may further be with or without restriction. This calculation can get a little complicated, so its best if you ask your tax advisor on the total amount that you will be eligible for. Also, different charities get treated differently, so best to seek professional advice on this matter depending upon the charity of your choice.

What are the eligible charities and charitable institutions where my donations are eligible for the deduction?

Common charities that are eligible for this deduction are the Prime Minister’s National Relief Fund, Prime Minister’s Drought Relief Fund. Before making a donation, please check with the charity if it is recognized and has been registered with the appropriate authorities.

If you make a donation to a notified temple, mosque, gurudwara or church, it might also be eligible but please confirm that this place of worship has been registered with the authorities. As mentioned above, donations made in kind are ineligible for the deduction, so make sure that you pay by cheque or bank draft and keep record of the transaction.

Please check with your tax advisor in case from time to time there are newer charitable institutions that become available or there are changes to the amount of deduction under 80G.

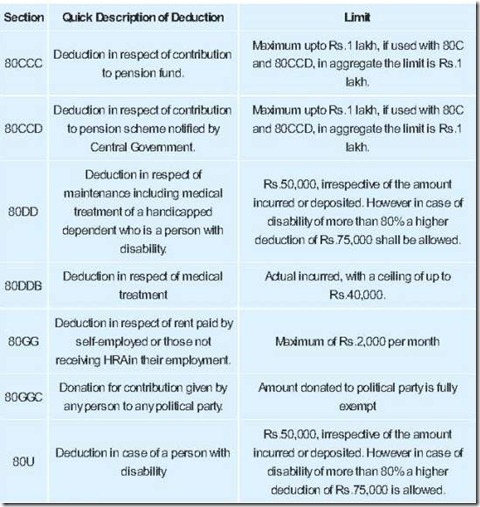

Less Commonly Used Tax Deductions

Under section 80 of the Income Tax Act, there are other less commonly used deductions. Please check with your tax advisor on how to use them, if you are eligible for these

Top Misconceptions about Taxes

Do I need to file my tax returns? How do I file them?

Misconception 1:

- My employer has deducted tax at source from my paycheck and thus I don’t have to worry about filing tax returns.

- Just because taxes have been paid on your behalf does not mean that filing a tax return is not required. If your combined annual income from all sources is above the amount that is exempt from income tax you are required to file your returns. Your employer gives to you a statement called Form 16 at the end of the financial year that shows the amount of tax that has been deducted at source. You will need to put the tax deduction amount shown on the Form 16 on your tax return form. Therefore, it is important to ensure that you obtain this statement from your employer on time.

Misconception 2:

- Filing tax returns is a complex and cumbersome process. I need a Chartered Accountant to help me file my tax returns.

- Contrary to popular belief preparing and filing a tax return is actually quite simple. In fact if you have a digital signature you can accomplish the entire process sitting at home on your computer thanks to the e-filing facility available on the tax department website (www.incometaxindiaefiling.gov.in). Alternatively, you can submit the returns online, print a one-page receipt, sign it and drop it off at the income tax office within fifteen days of submitting the returns. No documents are required to be submitted with the receipt. If you so desire, you can fill out the forms on your own. However, if you want professional help there are many third party service providers who offer tax preparation and filing services for as low as Rs.200.

Housing and tax

Misconception 3:

- he interest I pay on a home loan is deductible from my income from house property up to a maximum of Rs. 1,50,000 per year.

- This is true if you have taken a home loan for a single house and it is self-occupied. However, if you take a home loan on a second house, the entire interest paid on the loan can be claimed as a deduction from your income on house property. If you are planning to invest in real estate with the expectation that the property would appreciate in value over time, you could take advantage of the above rule. Thus a smart investment strategy would be to take a home loan on a second house, rent out the house and claim interest paid on the loan as a deduction from the rental income, thereby reducing your borrowing costs significantly.

Misconception 4:

- I receive tax exemption on the actual rent I pay for my rented home. This is not entirely accurate. Section 13 A of the Income Tax Act states that the maximum amount that is exempt from tax is the lower of the following amounts: (i) the House Rent Allowance given by the employer, (ii) 50% of your basic salary if you live in a metro, (iii) or, actual rent paid minus 10% of your basic salary. Thus if actual rent paid is lower than 10% of your basic salary you receive no exemption. The other key point is that you cannot claim any exemption under this section if you live in your own home or if you are not paying rent to anyone.

The magical 80’s

Misconception 5:

- Section 80C benefits are available only on making an investment or saving or paying a premium on insurance.

- You can claim a deduction for the school or university tuition fees you pay for your children (maximum of two) as long as they are enrolled in a full time program at any institute in India. In addition you can claim a deduction for the repayment of principal on any home loan that you may have taken. Both these deductions have to of course be within the overall annual Section 80C cap of Rs.1lakh.

Misconception 6:

- If I avail of tax free medical reimbursement from my employer up to Rs.15,000, I cannot claim deduction on health insurance premium paid.

- Tax free medical reimbursement by your employer up to an amount of Rs.15,000 per year for your family’s medical expenditure is separate from the Rs.15,000 deduction available under Section 80D for the premium you pay on buying health insurance. Both these exemptions are covered under different sections of the Income Tax Act and you can enjoy benefits from both. The former covers costs for your daily medical needs and outpatient treatment (OPD), while the latter protects you from expenditure for hospitalization.

Misconception 7:

- My friends tell me that the only interest payment I can claim an exemption for is the interest paid on home loans.

- There is a section of the Income Tax Act called 80E that permits deduction on interest paid on loans taken for higher education for self, spouse and children. There is no limit on the amount of deduction you can claim. The only thing to keep in mind is that the program for which the loan is taken should be a graduate or post-graduate program in engineering, medicine or management or a post-graduate course in the pure or applied sciences.

Interest income and others

Misconception 8:

- Interest I earn on my savings account balance is exempt from income tax.After the removal of Section 80L of the Income Tax Act, interest income from any source including savings account balance, is subject to income tax. What you may be referring to is the rule around tax deducted at source for the interest payments you receive on your savings account. As per existing rules, as long as the combined interest income that you earn, on any savings accounts or fixed deposits, at a single bank branch, is less than Rs.10,000 there will be no tax deducted at source. If you want to better manage your cash flow and do not want tax to be deducted at source you could consider spreading your deposits across multiple bank branches, even if they are of the same banking company.

Misconception 9:

- I have to pay taxes on interest received from my fixed deposits only on maturity.

- Your tax liability on interest income from your fixed deposit is calculated on an accrual basis. Let’s say that you have made a fixed deposit for three years and have elected not to receive any regular interest payouts and instead have decided to receive a lump sum payout on maturity after three years. That does not mean that you are not liable to pay income tax annually on the interest that is credited to your fixed deposit account every year, even though you do not have access to that interest income.

Misconception 10:

- I received cash as a gift from a close friend. I do not have to pay any tax.

- You are right as long as the amount was less than Rs.50,000 during the financial year. The applicable rules for gift tax state that any cash gifts, without any upper limit, received from specified relatives are exempt from income tax. However, if you receive a cash gift from a friend, which exceeds Rs.50,000 in one financial year, you are liable to pay income tax on the entire amount. However, the good news is that cash gifts received during your marriage, of any amount, and from anyone are totally free from income tax.

Regards,

Pinal Mehta

Human Resources

Understanding CTC and your Actual Salary

14 Dec Whether you are joining your first job or changing jobs, it is important to understand the difference between cost to company (CTC) and take home salary. It will help you in negotiate better with the HR and in structuring your salary.

Whether you are joining your first job or changing jobs, it is important to understand the difference between cost to company (CTC) and take home salary. It will help you in negotiate better with the HR and in structuring your salary.

One of the most commonly used terms by companies, yet least understood by its employees is ‘cost to company’ or CTC. The CTC, as quoted by employers and the take home pay are two different amounts.

Also salary hikes in the form of an increased CTC does not necessarily increase the monthly salary. So what exactly is CTC and as an employee what all are you entitled for?

This article aims to clarify the confusion that often arise in employees’ minds when it comes to salary structures.

Lets Understand about the CTC (Cost To Company)

Demystifying cost to company

Ravi Bhushan, a fresh software graduate, joined a top notch IT company. For his first job, he was extremely happy with the total CTC of Rs 6,00,000.

On the basis of this CTC, Ravi made lavish plans to spend his first month’s salary. Expensive gifts for family, a swanky new bike and the latest mobile phone. But when he got his first salary, he realised some of his plans had to wait.

His take home salary was nowhere close to his estimation. He approached his HR, who then explained the breakup of his CTC, which he had just glanced over at the time of joining.

Here’s what his HR manager explained to him:

The cost to company refers to the total expenditure a company would have to incur to employ you.

It includes monetary and non-monetary benefits, such as monthly pay, training costs, accommodation, telephone, medical reimbursements or other expenses, borne by the company to keep you employed. The total CTC need not be the actual salary in hand at the end of the month.

It is simply a sum of various components put together.

Components of CTC

Companies offer various attractive components in the CTC to retain and boost the morale of the employees. Whereas some salary components are fully taxable some are fully tax-exempt. The composition of your CTC and a few of its components could be grouped as below.

1. Fixed salary

This is the major part of your CTC and forms part of your monthly take home. It commonly consists of the following:

Basic salary: The actual pay you receive for rendering your services to the company. This is a taxable amount.

Dearness allowance: A taxable amount, this is paid to compensate for the rising cost of living.

House rent allowance (or HRA): Paid to meet expenses of renting a house. The least of the following is exempt from tax.

Actual HRA received:

-

50 per cent of salary (basic + DA) if residing in a metropolitan city, or else 40 per cent

-

The amount by which rent exceeds 1/10th of salary (basic + DA)

Conveyance allowance: Paid for daily commute expenses. Up to an amount of Rs 800 per month is exempt from tax.

2. Reimbursements

This is the part of your CTC, paid as reimbursements through billed claims.

Meal coupons: Many companies provide their employees with subsidised meal coupons in their cafeterias. Such costs incurred by companies in the form of subsidies are included in the CTC. Meal coupons are tax exempt provided it is not in the form of cash.

Mobile/Telephone bills: Telephone or mobile expenditure up to a certain limit is reimbursed by many companies through a billed claim, and is a taxable amount.

Medical reimbursements: Paid either monthly or yearly, for medicines and medical treatment. The entire amount is taxable. However, up to Rs 15,000 could be tax exempt, if bills are produced.

3. Retirement benefits

This is available to you only on retirement or resignation.

These include:

Provident fund: Employers contribute an amount equal 12 per cent to the provident fund account. This employer’s contribution though received only on retirement or resignation, is an expense incurred by the company every month and thus is included in your CTC.

Gratuity: Companies manage gratuity through a fund maintained by an insurance company. The payment towards the gratuity annually is sometimes shown in CTC.

4. Other benefits and perks

Leave travel allowance: It is the cost of travel anywhere in India for employees on leave. Tax exemption if allowed twice in a block of four calendar years.

Medical allowance: Some companies offer medical care through health facilities for employees and their families. The cost of providing this benefit to the employee could also form part of CTC.

Contribution to insurance and pension: Premiums paid by companies on behalf of employees for health, life insurance and Employees Pension Scheme, could form a part of the CTC.

Miscellaneous benefits: Other perks which companies include under CTC could be electricity, servant, furnishings, credit cards and housing.

Bonus: This is the benefit paid on satisfactory work performance for employee motivation. Though this amount is not assured to the employee, most companies include the maximum amount that can be paid as bonus, to the CTC. The two types of bonuses that are normally paid out are:

1. Fixed annual bonus: Paid on the basis of employee performance, either monthly or in most cases annually, it is a fully taxable amount.

2. Productivity linked variable bonus: Complete bonus amount is paid only on 100 per cent achievement of target, nevertheless it still is included as part of your CTC.

Moral of the Story :- Lessons learnt

Each company too has its own way of calculating the cost to company. Let us revisit Ravi’s case.

Ravi realised, that an attractive CTC does not necessarily indicate a heavy monthly take home. Benefits like training and development, whether undertaken by him or not was still considered part of his CTC. Here is what one should keep in mind:

One must take time to find out what the actual benefits are by asking for the break-up of the CTC so as to know the entitlement.

If you are just joining the company, try to negotiate with the HR as to opting out of some facilities in exchange for increasing the take home.

Understand the expenditure limits and tax angle of perks and benefits, and use them smartly.

Here is a Sample Salary Breakup of a MID – LEVEL Manager

Thanks and Regards,

Pinal Mehta

Source:- Rediff Files

HR Article :- 9 Qualities that will Rock your career

7 Dec Success in life is always relative. Some people are happy with small achievements while there are others who won’t be satisfied until mountains are moved.

Success in life is always relative. Some people are happy with small achievements while there are others who won’t be satisfied until mountains are moved.

Regardless of our ambitions, our career spans through a series of jobs and experiences that truly polish our personality and will. While we all have defining moments that will determine our core beliefs around hard work, persistence, determination, etc., these are all simply components of a greater foundation that defines ‘you’. A rocking rise through corporate ranks involves a radical understanding and possible change in your attitude and behaviors.

There are millions of brilliant people who pursue aggressive career paths and have their sights set on great achievement. While their ability is nothing short of genius, many lack the soft skills that could put them over the top. These are the traits, qualities and understandings are what make good people great. Practical and time tested, mastering and practicing the following qualities will make if difficult for success to elude you.

- Out of Box Thinking

Many dislike this term but the concept is for real. All it requires is thinking of problems though a different set of eyes, or different dimension. This is why many brainstorming sessions fail; most people sit and think of work problems in the context of what it means to the company, not the user, not the environment, etc. Sit back and try to solve the problem from the eyes of a 6 year old, turn things upside down, and absolutely challenge the norm. Go outside and sit in a subway station (or somewhere you generally don’t sit to work) and think about why other solutions not worked? What has worked?Remember the best ideas come from people who are hands-on with their work. When everyone thinks and recommends a lackluster way, lackluster results will follow. Change your surroundings, change your views, change your thought process and come up with a killer idea!

- Taking Ownership

When no one is willing to own it, be the first to grab the opportunity. A process involving various stakeholders normally loses vision and momentum. A process with a good leader, input from others, and true direction, has a much better chance of success. Be the person that jumps in and takes on a new project (just don’t over-commit). An ability to own and work towards success is a skill which gives long lasting returns. - Eagerness to Learn

After a certain period, a job becomes monotonous and people become bored and eventually even lazy. They lose all the zeal to learn new things and although they won’t admit this, their actions would make you believe they have thrown in the towel and are satisfied with a status quo life and career. If you really want to move ahead, don’t get into this rut. Don’t tune out.Always remain eager to learn; you never know what knowledge or capability will push you up in your career. Remember, you need an open mindset and positive attitude to approach work. If you are constantly learning, it will be tough to be or appear to be interested in mediocrity.

- An Eye for Detail

If you are hands on with your work there is no reason why you won’t know the intricacies involved. Therefore, have the confidence needed to make difficult choices. When you master something and know the minute details, your logic and ideas will be highly regarded. While people love to argue, they get easily impressed by intelligent reasoning too. - Willingness to Help

Much of life is give and take. Work is no exception. If you are the person that is constantly stepping out of your comfort zone in order to help others, people (most) will return the favor when you ask. That’s the key though, you have to be willing to help someone and not too proud to ask them for help when you need it. - Networking

Your network should never be restricted to people in your domain but it should span other departments too. Again, break away from comfort and get engaged with someone from a different department. When you sell yourself in the market, you need people who can vouch for you and the broader the network, the better. A strong network always gives you an upper hand, not only to receive but also influence the information flow. - Solution Seeking Mindset

People love to mention and talk about problems. However, when you ask for their solutions to those problems, they aren’t willing to go on record with sweeping changes. The majority of employees lack an attitude to solve issues and love to keep them burning for long time, almost to encourage sympathy. It is these times that a positive mindset can send the right vibes across and can really give you a lot of attention. Don’t avoid complainers, listen to them just long enough to hear the problem, then try to come up with a solution. - Humility

Arrogance has its own advantages but it never attracts more people than the magic done by humility. When you know your work and are humble about it than there is no reason that you would not get the desired appreciation. Humility needs to be pitched with much care lest it lets people take undue advantage of you. Strike the right balance and you would see its real magic. - Being Practical

Human beings are emotional and many fall for popular decisions. A practical decision made at right time with right attitude has the ability to shower you with long lasting fame. Remember, the people who are at the top are nothing but practical.

It is a jungle out there where you not only need to survive but flourish too. Develop the killer attitude for success and no one would ever dare to stop you.

Always

- Work Hard, Work Smart

- Make sure the world knows about it

- Make sure to sell it in right manner to right people

Go, Get Success

Regards,

Pinal Mehta

HR Article :- Promotion can be a double-edged sword

3 DecWINNING WAYS IN MANAGEMENT

Question:

My problem may not seem like a problem to you, but it has me completely panicked. My last project was considered ”huge” success, and as a result, I was promoted up three rungs to run department. I don’t have the experience or the knowledge to do this job. What should I do ? –Anonymous, Hartford, Connecticut

Answer:

Congratulations.

You’ve stumbled upon one of the best-kept secrets about work.

Getting promoted is a double-edged sword:

Thrilling, yes, but terrifying too. Everyone is calling you with hearty congratulations and slapping your back, saying you deserve it, and you’re smiling away for them all, feeling a lot less jovial than you look.

It doesn’t matter if it’s your first managerial stint or you move into the CEO’s office.

You are the only on e who truly comprehends how little you know about the new job, especially when compared to the big, bold expectations your bosses keep mentioning.

Whatever happened, you want to scream, to the perfectly logical idea of a grace period?

It’s best not to scream, of course.

After all, you’ve been told that leaders need to appear clam and in control, and that’s true.

Leaders should look and act like leaders for the sake of their people’s respect and confidence and the organization’s forward momentum.

But being a leader doesn’t mean you can’t ask questions: Good leaders are, by definition, insatiable learners, relentlessly probing the mind of people at every level for ideas and insights.

They are voracious relationship builders too, and make sure they get to know everyone in the business who can open their eyes to the who, what and when of the job.

Obviously, you don’t ever want to seem clueless, and we can’t imagine you would, given your past success.

You want to appear deeply inquisitive about every aspect of your business and passionate about helping your people to achieve everything necessary to win.

Those traits won’t undermine your authority.

They’ll enlarge it.

Are we asking you to fake it? No. we’re asking you to reinvent your self-perception according to reality.

Right now, you’re experiencing the same feelings that most new leaders do.

Do you think that a president feels any different when he’s made the leap from say, running a little southern state to having his finger on the nuclear trigger? Being in charge of something new starts the game all over again, no matter what you’ve done before.

You dub yourself “not ready.”

We’re saying that you should dub yourself “normal.”

And you will eventually learn what you need to know to do your new job.

Six months or a year from now, there will even be days when you feel on top of it all.

But business today changes too fast and has too many variables for any manager to ever have the sustained sense of security you yearn for.

Indeed, part of being a leader circa 2007 is being able to live with an “uh-oh” feeling in your stomach all the time.

Don’t let that panic you more! Instead, consider the proposition that continually feeling a bit overwhelmed and under informed is a positive thing for both you and your business.

Everyone knows that too much confidence can lead to arrogance and inertia based on “that’s how we do it around here.” The flip side is an insatiable hunger for new ideas and better ways of doing things – a hunger that makes you fight like hell to win.

Archived from ‘The New York Times News Service‘

Posted with WordPress for BlackBerry.

HR Articles :- Top Signs Your Employees Are Not Engaged

3 DecA tongue-in-cheek look at some signs that employees are not engaged, followed by proven action plans to improve that situation.

For decades, studies have shown that employee engagement has a direct influence on a company’s financial performance, its capacity to recruit other high performers and its ability to retain top talent.

To put a slightly off-kilter spin on employee engagement, here’s a list of signs your employees are not engaged, followed by an action plan that companies can implement to improve employee engagement within their organization.

Signs to be on the look-out for are:

1. Your employees are more satisfied with new episodes of MTV’s Jersey Shore than company benefits.

Action Plan:

Use an employee e-newsletter to regularly educate employees about their healthcare, vision and dental benefits, highlighting specific updates and special perks.

2. Your employees never show up to work on time yet always arrive at company parties 15 minutes early.

Action Plan:

Hold a time-management training seminar, teaching employees how to better manage their time and priorities.

3. Your employees are more interested in using Groupon to save them money than finding innovative ways to save the company money.

Action Plan:

Reward employees who come up with cost-saving ideas that will benefit the company’s bottom-line.

4. Your employees spend more time talking to their co-workers about their crazy weekend than completing important projects.

Action Plan:

Have teams establish ground rules for working together. Post them in a public place and encourage all team members to hold each other accountable to the new rules.

5. Your employees trust politicians more than they trust senior management.

Action Plan:

Make senior management more available and visible to employees to build trust.

6. Your employees remember their sister’s husband’s brother’s birthday but forget how to complete easy, painless work-related tasks.

Action Plan:

Ensure employees are aware of all the tools, software and equipment available to them and provide training to make sure employees understand how to use them to their full potential.

7. Your employees would rather voice their displeasure with their jobs on “www.ihatemyjob.com” than with their supervisors.

Action Plan:

Develop “office hours” for employees to openly voice their opinions and give suggestions to their supervisors.

8. Your employees call in sick on the same day and time every week.

Action Plan:

Institute an incentive policy where employees who accumulate a set number of unused sick days can earn an additional vacation day.

9. Your employees build origami out of important project materials instead of reading them.

Action Plan:

Hold monthly brainstorming meetings to allow employees’ creative sides to come out, generating new, innovative ideas for upcoming projects.

10. Your employees believe the odds of their favorite NFL team winning Super Bowl are better than the odds of their supervisor offering them a job promotion.

Action Plan:

Conduct one-on-one meetings with employees to discuss career growth and opportunities for advancement.

These signs and others like them require immediate action by management to prevent against continued disengagement.

By establishing a sound employee-engagement strategy and executing the aforementioned action plans, organizations will be well on their way toward improving their employees’ engagement levels, and, more importantly, retaining their top talent as the economy recovers.

[About the Author: Kevin A. Sheridan is CEO/Chief Consultant at HR Solutions.]

Regards,

Pinal Mehta

HR CaseStudy:- When Grapevines are Good (Gossip’s @ Workplaces)

3 DecGossip, just like social media, is an exchange of information between two or more people typically about a third, absent party. Managers may view their lack of control in such a democratic environment as a threat. Instead, they should look at the positive powers of gossip as a tool to diagnose or influence workforce issues.

Call it whatever you like, the grapevine, water cooler, gossip or the rumor mill. Conversations among co-workers happen. As human beings, we are social creatures who crave community, engagement and interaction.

Whether it’s talking shop about the boss, layoff rumors after a less-than-satisfying quarterly earnings report or gossip about Susie in Accounting and her supposed office extra-curriculars, conversations among co-workers are a guarantee.

Management has battled with gossip and the grapevine since the beginning of time. Supervisors are quick to lay blame to wildfire rumors, half truths and innuendos at the office as being detrimental to workplace productivity and undermining management authority. However, a recent study by two doctoral candidates at the University of Kentucky sheds some light on the positive power of gossip in the workplace.

Some Points to Ponder:

1. Gossip improves an employee’s social understanding of his or her environment.

This concept is the basis of cultural anthropology and the concept of micro-cultures. Workplace cultures are no different.

2. Gossip is natural.

According to the University of Kentucky study, 96 percent of employees admit to engaging in gossip at work.

3. It’s not all negative.

Nearly three-quarters (72 percent) of gossip was an even blend of both positive and negative. Only 7 percent of gossip was largely negative.

4. Negative gossip

Negative gossip is a symptom of a larger organizational problem.

Just like a fever or runny nose alerts an individual to an infection, negative gossip is no different.

5. Perception is Reality.

Prior to the written word, the grapevine was a form of historical storytelling and news distribution. Sometimes, the spoken word is more reliable than the written word in the workplace. Visit any break room or smoking section as a covert HR operation and you’ll see exactly what I mean.

Just as social media is about engagement and influence outside of a brand’s scope of control, so, too, is the workplace grapevine outside of a manager’s control. Gossip, just like social media, is an exchange of information between two or more people typically about a third, absent party.

And managers view their lack of control and that democratic environment as a threat, instead of a tool or channel in which to diagnose or influence a situation or scenario. There is no silver bullet to managing gossip in the workplace or via the Internet. One size does not fit all, but here is some food for thought:

1. Conversations require at least two people.

Managers should be talking to their teams just as companies should be talking to their customers. After all, employees are our biggest asset and advocate for our companies and brands.

2. Don’t bribe or threaten the workforce.

Just as in branding, you must be authentic. People are smart, cynical and suspicious. Have conversations, mean what you say and keep your promises.

3. Don’t be afraid of the negative.

Hearing negative feedback about our style as a manager is hard, but if we fail to listen to our audience (our consumers), we risk feeding the best.

With the Internet, nothing is secure. Your team is not only gossiping at work but also on social-media platforms and forums, not just Facebook. Glassdoor.com and forums on Indeed.com are common sites where employees go to let off steam squarely within the public eye and with open access.

4. Survey the troops.

If you don’t already, facilitate an employee-engagement survey. Use tools such as exit interviews and other employee surveys for feedback. It doesn’t have to cost anything; they can be created for free by using online tools such as Survey Monkey.

For thousands of years, the workplace grapevine has been a social and cultural case study in action. Rumor mills, shared assumptions and opinions have long been a part of what makes our place of work interesting, enjoyable, intolerable or entertaining.

Social-media experts are quick to segment the social audience when working on marketing or public-relations campaigns. Managers and human resource professionals should do the same.

In Groundswell, authors Charlene Li and Josh Bernoff identify six groups who can be found in social media. While these profiles were created for social-media purposes, I believe they can be used in a workplace context.

The profiles can help identify the different types of workplace influencers and their involvement in what makes the community flow and how thoughts and ideas are influenced.

a) Creators.

These individuals are extremely socially active and are enthusiastic about their hobbies, passions, dislikes or love of a product, brand, company or service.

They are connected and have an established and strong community, and are seen as an authority because of their extensive research and ability to vet information to others.

b) Critics.

These individuals are extremely vocal and use either online or word-of-mouth to rate and critique products and services.

These individuals can be your best allies, especially if you have a great customer-service department, stellar management team or new program you are rolling out to the staff. Don’t be misled by word “critic” as having a negative connotation. These team members can be an evangelist for your organization and culture.

c) Collectors.

These individuals have a great deal of influence and can generate a great deal of chatter in a short amount of time because of their extensive network and passion for sharing information.

These team members focus on collecting information and content for sharing with other members of their active community.

d) Joiners.

These individuals want to feel like they belong to something. If online, they are very active on community sites like Facebook and are extremely engaged in places that involve a sense of community such as churches and professional organizations.

Their ability to connect with many individuals and persons is a draw for team members. They often join for the sake of joining — to belong.

e) Spectators.

These individuals love to sit back, watch and enjoy taking in the environment and situation to soak up all information.

Online, these individuals are focused on using ratings and reviews to draw conclusions. Don’t be surprised if they use these same methods of surveying and gathering data when engaging and influencing your organization.

f) Inactives.

These are those individuals who are present and listening but not participating and engaging. They have one ear to the wall but have not made an effort to actively participate within the organization or culture. Just as they would do online.

[About the Author: Jessica Miller-Merrell, SPHR, is an author, speaker and consultant. She is a leader in the HR social-media community and her book, Tweet This! Twitter for Business, was released in February. Her company, Xceptional HR provides businesses with social-media and recruitment strategies, and human resources consulting.]

“Indian Labour Law” Legal Case Study:- Usage of Vulgar Language

29 Nov This is an attempt to compare the judgments delivered in the 1960 To 1990’swith that of judgments delivered from 2001 onwards. The Indian Economy has undergone significant changes after the introduction of liberalization and globalization. The Indian Judiciary has also taken a note of the prevailing circumstances and there is a different direction taken by the Indian Judiciary in the recent years.

This is an attempt to compare the judgments delivered in the 1960 To 1990’swith that of judgments delivered from 2001 onwards. The Indian Economy has undergone significant changes after the introduction of liberalization and globalization. The Indian Judiciary has also taken a note of the prevailing circumstances and there is a different direction taken by the Indian Judiciary in the recent years.

USAGE OF VULGAR LANGUAGE

Earlier whenever the cases relating to usage of vulgar or abusive language reaches the court of law, the courts have taken a view that the workers basically came from the families of without much education background and they have grown in a society where usage of decent language was not possible. Therefore keeping in view of their social status, the courts have granted relief in favour of the workers even such misconduct was duly proved. Reference can be made to the case of Ramakant Mishra Vs State of UP reported in 1982 Lab ic page no.1790 SC.

However, now the Supreme court in the year 2005 LLR page 360 in the case of Mahendra and Mahendra Ltd., Vs. N.V. Naravade held that usage of abusive and filthy language against superior officer held that did not call for lesser punishment than dismissal.

Regards,

Pinal Mehta

Sach Ka Samna – “Leadership Scruples”

19 Nov

I’ve been watching an “Bindaas TV series where they ask Teenagers and on-goers a Morally / Ethically Challenging Question to answer. It’s a fascinating study of human behavior. Everyday people are secretly filmed in situations where they are faced with a choice.When I saw the last one, I thought it might be interesting to resurrect an old game known as “Scruples”, and create a “Leadership Scruples” game, or a series of workplace “What Would You Do” scenarios for leaders. Actually, it doesn’t have to be for just formal leaders… anyone can play… I’ve just tried to give it a leadership slant to better fit the purpose of this blog.

Here are some Questions, Let See if you can answer them:

1. You’re at a hotel and conference center. You’ve arrived to your meeting early, and have not have a chance to eat breakfast yet. On your way to your meeting room, you walk by another meeting and there’s a table full of food and beverages outside the room. Your meeting has no food. Would you help yourself?

2. Your manager congratulates you for a brilliant suggestion and hints at a promotion. Your employee gave you the idea. Do you mention this to the manager?

3. You’ve made a verbal agreement with a supplier. A competitor offers you a deal for 50% less. Do you take it the deal?

4. A colleague is out of his office. You notice his paycheck stub on his desk. Do you glance at it?

5. Your manager demands to know what a co-worker is saying behind his back. It’s not flattering. Do you tell him?

6. You’re reviewing the results of an employee survey and accidentally discover a way to see individual responses and comments. Do you keep reading or report the problem?

7. You’re traveling in Ladakh on business when you’re invited to a feast by shepherds. You’re given the sheep’s eyeball, the greatest delicacy. To refuse it is the greatest insult. Everyone’s watching. Do you gulp it down?

8. As a joke, a co-worker sends anonymous love letters to another co-worker who takes them seriously. Everyone is enjoying the prank. Do you expose it?

9. A disgruntled worker is brandishing an automatic weapon. You’re near a door. If you try to warn others you may not escape. Do you save yourself?

10. After closing a big deal, your manager surprises you with a warm, lingering hug. Do you tell your manager you’re not comfortable with this?

11. You’re playing tennis with your manager for the first time. You’re winning and your manager is getting angry. Do you let him win?

12. You want to quit a job without notice but you need a good reference from your employer. Do you invent a family health emergency?

13. You decide not to hire someone because he’s wearing a nose ring. When he asks why he didn’t make it, do you give the real reason?

14. You find an expensive pen in an airport lounge. Do you keep it?

15. A close friend will be interviewed for a job with your employer. He asks you for a list of the questions in advance. Do you supply it?

16. You have a struggling young company. You have to choose between two equal candidates for a job, a man and a woman. The woman will work for Rs.20000 per year less than the man. Do you hire her for that reason?

17. You’ve just been promoted to manager at the branch where you work. The person you’re dating has applied for a job there and would be reporting to you. Is this OK?

18. The customer wants a refund. You agree that a refund is called for but company policy says “No.” If you go to Corporate, the customer’s refund will be denied. If you act on your own authority, the customer will be satisfied, but you may get in trouble. What would you do?

19. The company procedure is very clear but you know a “better” way to do the job. Your productivity results are a bit low this month. If you use your new approach (and violate the “rules”) you can raise your results to an acceptable level. What would you do?

20. You are working to correct a mistake that your manager doesn’t know about. If you tell your manager, you will be blamed for the mistake. If you don’t tell your manager, you’ll miss your deadline. Do you tell?

Please Share your views and answers for the Same

Regards,

Pinal Mehta